Are you thinking about trying to sell your house by owner in Traverse City – Leelanau County – or the Grand Traverse Area? Financial guru Dave Ramsey explains why he doesn’t recommend selling your home buy owner. Check out his podcast here:

http://www.daveramsey.com/index.cfm?event=askdave/&intContentItemId=118273

If you are considering selling your home by owner, what do you have to lose by contacting Oltersdorf Realty LLC? We would be more than happy to sit down with you for a no obligation presentation on what our marketing campaign can do for you. Study after study has proven that a high volume full time professional can sell your property faster and for more money than you can FSBO (for sale by owner). Oltersdorf Realty, LLC continues to be ranked in the top 1% of all Traverse City Area Association of Realtors year after year. No one has a more detailed and complete marketing strategy aimed at reaching the highest number of potential home buyers. Experience counts!

If you are determined to only sell your home or property yourself, please contact us to let us know that you have put your real estate on the market! We are constantly in contact with potential buyers and our goal is always to find our clients the right home, including houses and property for sale by owner!

Oltersdorf Realty, LLC

/

E-mail: realestate@oltersdorf.com

Phone: 231-271-7777

On December 17, 2010, President Obama signed into law the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (H.R. 4853) extending the Bush-era tax rates and a host of other expired and expiring provisions. The legislation is not "paid for," so there are no revenue raisers taken from real estate or other industry groups. The package provides temporary extensions of its numerous provisions. Some are retroactive, as well, so that the rules that had been in place previously will operate as if they had never expired.

Included in the bill are provisions that affect real estate investment and operations—such as energy-efficiency tax credits, capital gains, and more. A few key provisions of interest to REALTORS® include:

•• Retention of Bush-era tax brackets through the 2011 and 2012 tax years;

•• Retention of the capital gains tax rate of 15 percent for assets sold or disposed of during 2011 and 2012;

•• Reduction of payroll taxes for employees and self-employed individuals during 2011;

•• Extension of numerous energy efficiency credits through December 31, 2011, including: the Energy Efficient New Homes, Energy Efficient Existing Homes, and Energy Efficient Buildings credits.

Read a summary of the real-estate provisions in the tax bill > (PDF: 222K)

Source:http://www.realtor.org/government_affairs/bush_tax_cut_extension

Copyright National Association of REALTORS®. Reprinted with permission.

The Leelanau Conservancy has put together a fantastic video highlighting their 2010 accomplishments as well as showcasing the beautiful scenery that surrounds Leelanau County, Michigan! Thank you to all of the volunteers that reside in Cedar, Empire, Glen Arbor, Lake Leelanau, Leland, Maple City, Northport, Omena, Peshawbestown, and Suttons Bay!

Oltersdorf Realty, LLC

/

231-271-7777

4252 Eagle Vale - Traverse City Condo - SOLD 12-15-10

223 S Elm St, Suttons Bay - SOLD 12-1-10

892 Bay Cliff Dr, Suttons Bay Condo - SOLD 11-30-10

A beautiful house that we sold on East Bay last month was featured as the Wall Street Journal's "House of the day" over the summer. You can view the slideshow by clicking HERE!

I will have the year end 2010 sales statistics for you within the first couple of weeks of 2011. It appears that sales volume and the number of houses sold during 2010 will be well above 2009 values. Please check back often!

UPDATE 12/27/10: On December 22nd, 2010, Governor Granholm VETOED supported legislation aimed at getting the housing market moving. Senate bill 77, which passed both the House and Senate in the last days of the 2010 session, allowed foreclosed properties to retain their principal residence exemption for a period of up to 3 years.

The Michigan Association of Realtors has recently posted a podcast discussing the potential outcome of Senate Bill 77 known as the “General Property Tax Act”. This bill could potentially extend the homestead exemption deadline from May 1 to a later date in the year. If you are planning on purchasing a primary home in Leelanau County or Grand Traverse County - Traverse City after May 1, 2011 you definitely should keep your eye on the outcome of this bill! I have also touched on this bill in a previous post found HERE and highlighted below.

"Currently, if you purchase a home in Michigan after May 1st and the house is currently not considered a “primary residence” the property taxes for the entire year will be based on the non-homestead tax rate which can be up to 18 mills higher. This would extend the deadline to October 1st which is great news for home buyers who purchase throughout the summer and intend to use the house as their primary residence if the seller is not currently taking advantage of the principal homestead exemption. "

-Jonathan Oltersdorf-

/

231-271-7777

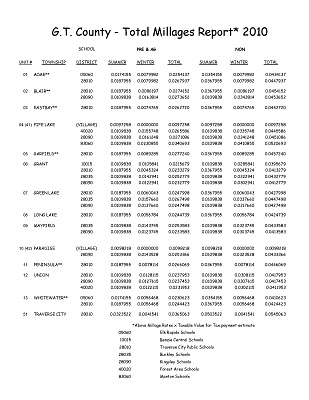

Below is the apportionment chart provided by the Grand Traverse County – Traverse City Equalization Department showing anticipated 2011 millage rates. This is the chart that is used to figure your estimated 2011 tax bill. In late February all Grand Traverse County – Traverse City property owners will be mailed their new notice of assessment informing them of their updated 2011 State Equalized Value and Taxable Value on their property. Have you ever wondered what your property taxes would be if you lived in another township, or if you switched your homestead status to your non-primary home? The chart below is extremely helpful in comparing property taxes in all Grand Traverse County Townships whether you are in the City of Traverse City or Long Lake Township, etc. You can download the PDF by clicking HERE or on the image below. To figure your estimated tax bill, take your taxable value from your notice of assessment (or approximate house value divided by 2) and multiply it by your township millage rate on the chart (make sure you have the correct school district and homestead status).

For Example – Downtown Traverse City primary home with a Taxable Value of $100,000 (house value of $200,000)

$100,000 * (0.0365063) = A yearly tax bill of $3,651

Note: Compared to 2010 property tax rates this home owner will save $120.00. Proposed millage rates will be 3.5% lower in the City of Traverse City.

DOWNLOAD THE CHART BELOW BY CLICKING HERE http://www.oltersdorf.com

http://www.oltersdorf.com

231-271-7777

Below is the apportionment chart provided by the Leelanau County Equalization Department showing anticipated 2011 millage rates (this chart was amended November, 2010). This is the chart that is used to figure your estimated 2011 tax bill. In late February 2011 all Leelanau County property owners will be mailed their new notice of assessment informing them of their updated 2011 State Equalized Value and Taxable Value on their property. Have you ever wondered what your property taxes would be if you lived in another township, or if you switched your homestead status to your non-primary home? The chart below is extremely helpful in comparing property taxes in all Leelanau County Townships whether you are in Suttons Bay Township, Leelanau Township, Leland, Bingham, Elmwood etc. You can download the PDF by clicking HERE or on the image below. To figure your estimated tax bill, take your taxable value from your notice of assessment (or approximate house value divided by 2) and multiply it by your township millage rate on the chart divided by 1000 (make sure you have the correct school district and homestead status).

For Example – Suttons Bay Township primary home with a Taxable Value of $150,000 (house value of $300,000)

150,000 * (21.0567/1000) = A yearly tax bill of $3,158

DOWNLOAD THE CHART BELOW HERE

231-271-7777

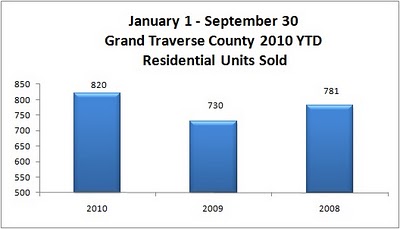

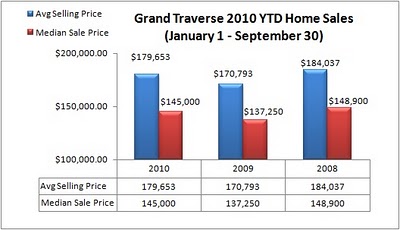

I have calculated the updated 2010 home sales data for Traverse City / Grand Traverse County and have posted the information below. The sales statistics compare housing sold in Grand Traverse County from January 1, 2010 through September 30, 2010 to the same time period in 2009 and 2008. This includes the townships of Acme, Blair, East Bay, Fife Lake, Garfield, Grant, Green Lake, Long Lake, Mayfield, Paradise, Peninsula, Union, Whitewater, and the City of Traverse City. As you will see in the data below, the number of homes sold is up over 12% in 2010 compared to the same time in 2009. Home sales volume in Grand Traverse County is up 18% this year over 2009. Average sales price and median sales price also have increased 5.6% and 13% over last year to date. We are seeing the same trend for home sales within Leelanau County as well. Overall it has been a busy year for real estate in the Grand Traverse Region.

This report is based upon sales information obtained from the Traverse Area Multiple Listing Service from 2008-2010. Undisclosed sales are not included in the data. This is for basic review purposes only. All attempts for accuracy have been made but cannot be guaranteed.

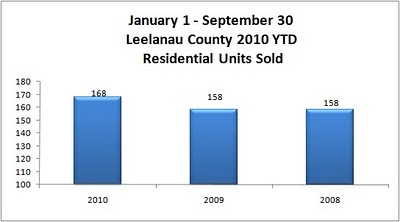

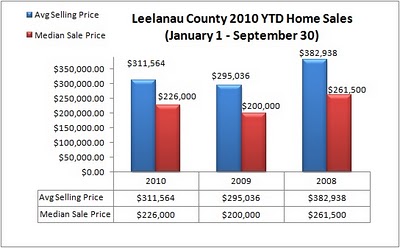

I have calculated the updated 2010 home sales data for Leelanau County and have posted the information below in several charts. The sales statistics compare housing sold in Leelanau County from January 1, 2010 through September, 2010 to the same time period in 2009 and 2008. This includes the townships of Bingham, Centerville, Cleveland, Elmwood, Empire, Glen Arbor, Kasson, Leelanau, Leland, Solon, Suttons Bay, and the City of Traverse City within Leelanau County. As expected home sales are well ahead of 2009’s numbers and current record low interest rates aren’t hurting as we transition into the end of fall. In Leelanau County the number of homes sold has increased 6.3% in 2010 over 2009. Median sale price and average sales price has increased in 2010 over last year’s values 5.6% and 13% respectfully. Sales volume remains ahead of last year’s pace with an increase of 12.2% to date. Grand Traverse County and Traverse City has been seeing a large increase in real estate sales during 2010 as well.

This report is based upon sales information obtained from the Traverse Area Multiple Listing Service from 2008-2010. Undisclosed sales are not included in the data. This is for basic review purposes only. All attempts for accuracy have been made but cannot be guaranteed.

You can view an updated post on this topic by clicking HERE!

UPDATE: On December 22nd, 2010, Governor Granholm vetoed MAR-supported legislation aimed at getting the housing market moving. Senate bill 77, which passed both the House and Senate in the last days of the 2010 session, allowed foreclosed properties to retain their principal residence exemption for a period of up to 3 years.

Look for this to be reintroduced sometime in early 2011.

What does this mean to home buyers and sellers in Northern Michigan?

Currently, if you purchase a home in Michigan after May 1st and the house is currently not considered a “primary residence”the property taxes for the entire year will be based on the non-homestead tax rate which can be up to 18 mills higher. This would extend the deadline to October 1st which is great news for home buyers who purchase throughout the summer and intend to use the house as their primary residence if the seller is not currently taking advantage of the principal homestead exemption. This is also very beneficial to some sellers, especially within our Traverse City region (Grand Traverse County & Leelanau County) because of the large amount of second homes on the market. If you are selling a non primary residence home, currently you must sell that home before May 1st to a buyer who will file the principal residence exemption form in order for you to prorate your tax portion at a lower millage rate for the year of the sale. If they extend the date to October or November it could potentially reduce your tax bill significantly for the entire year, even if you sell in late summer/early fall. You can read the full press release below. Please let us know if you have any additional questions!

-Jonathan Oltersdorf

http://www.oltersdor.com/

Senate Bill 77, sponsored by Senator Jud Gilbert (R – Algonac) unanimously passed the Michigan Senate today with a vote of 36-0 and now moves to the House of Representatives for consideration. This legislation would provide for an additional “Principal Residence” filing date of October 1st. It should be noted that an amendment has been added to the legislation to move the deadline from October 1st to November 1st for 2010 only so that homebuyers can take advantage of this taxpayer friendly legislation this year.

Under current law, homeowners may file a principal residence exemption on their primary home in Michigan. This exemption provides significant tax relief to those citizens that choose to call this state “home.” In order to claim this exemption, one must file the principal residence affidavit with their local government by May 1st. Buyers purchasing homes after the May 1st deadline, are hit with up to an additional 18 mills of non-homestead property taxes until the following year. This additional property tax burden is standing in the way of new homeownership and otherwise taxing those people that have declared Michigan their home, though they purchased after the deadline.

This legislation has become particularly important since “non principal residence” properties, specifically foreclosures, have flooded Michigan’s real estate market in recent years. The current situation prices buyers out of homes by forcing them to qualify for a mortgage at the higher tax rate. Those buyers that are able to purchase after May 1st are consequently stuck with a significant tax burden for the remainder of the year despite making that new purchase their principal residence. This bill would alleviate some of that pressure by creating a second filing deadline later in the year.

We remain cautiously optimistic regarding the passage of this legislation as there are a finite number of session days left this legislative session. The MAR Public Policy staff will continue to meet with the members of the Michigan House to express the importance of making this tax payer friendly legislation a priority.

Copyright Michigan Association of REALTORS®. Reprinted with permission.

I have calculated the updated 2010 home sales data for Traverse City / Grand Traverse County and have posted the information below. The sales statistics compare housing sold in Grand Traverse County from January 1, 2010 through August 31, 2010 to the same time period in 2009 and 2008. This includes the townships of Acme, Blair, East Bay, Fife Lake, Garfield, Grant, Green Lake, Long Lake, Mayfield, Paradise, Peninsula, Union, Whitewater, and the City of Traverse City. As you will see in the data below, the number of homes sold is up over 13% in 2010 compared to the same time in 2009. Home sales volume in Grand Traverse County is up 17% this year over 2009. Average sales price and median sales price also have increased 3.7% and 5.6% over last year to date.

This report is based upon sales information obtained from the Traverse Area Multiple Listing Service from 2008-2010. Undisclosed sales are not included in the data. This is for basic review purposes only. All attempts for accuracy have been made but cannot be guaranteed.

I have calculated the updated 2010 home sales data for Leelanau County and have posted the information below in several charts. The sales statistics compare housing sold in Leelanau County from January 1, 2010 through August 31, 2010 to the same time period in 2009 and 2008. This includes the townships of Bingham, Centerville, Cleveland, Elmwood, Empire, Glen Arbor, Kasson, Leelanau, Leland, Solon, Suttons Bay, and the City of Traverse City within Leelanau County. As you will see in the data below home sales throughout Leelanau County are up 13% in 2010 over 2009. Median sale price and average sales price has increased in 2010 over 2009 due in large part to strong August sales of higher priced waterfront homes. Sales volume remains far ahead of last years pace with an increase of 23.3% to date. Grand Traverse County and Traverse City has been seeing a large increase in real estate sales during 2010 as well.

This report is based upon sales information obtained from the Traverse Area Multiple Listing Service from 2008-2010. Undisclosed sales are not included in the data.

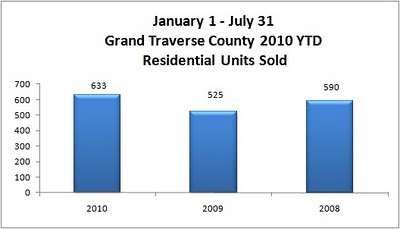

.jpg)

I have calculated the updated 2010 home sales data for Traverse City / Grand Traverse County and have posted the information below. The sales statistics compare housing sold in Grand Traverse County from January 1, 2010 through July 31, 2010 to the same time period in 2009 and 2008. This includes the townships of Acme, Blair, East Bay, Fife Lake, Garfield, Grant, Green Lake, Long Lake, Mayfield, Paradise, Peninsula, Union, Whitewater, and the City of Traverse City. As you will see in the data below, the number of homes sold is up over 20% in 2010 compared to the same time in 2009. Home sales volume in Grand Traverse County is up 24% this year over 2009. Average sales price and median sales price also have increased 3.1% and 4.4% over last year.

I have calculated the updated 2010 home sales data for Leelanau County and have posted the information below in several charts. The sales statistics compare housing sold in Leelanau County from January 1, 2010 through July 31, 2010 to the same time period in 2009 and 2008. This includes the townships of Bingham, Centerville, Cleveland, Elmwood, Empire, Glen Arbor, Kasson, Leelanau, Leland, Solon, Suttons Bay, and the City of Traverse City within Leelanau County. As you will see in the data below home sales throughout Leelanau County are up 6% in 2010 over 2009. Median sale price has decreased slightly in 2010 over 2009 due in large part to the first time home buyer credit push this spring. Sales volume remains relatively steady with a 2% decrease. Although the 2010 numbers in Leelanau County aren't as high as property owners have hoped, Grand Traverse County has been seeing a large increase in real estate sales during 2010 which will eventually carry over to Leelanau County. Sales in Leelanau typically stay strong through the end of summer and fall.

This report is based upon sales information obtained from the Traverse Area Multiple Listing Service from 2008-2010. Undisclosed sales are not included in the data.

This is great news for Traverse City -Leelanau home buyers who plan on financing a home purchase through the popular RD loans that are available in our area. These types of loans provide qualified buyers a chance to own a house with little or zero downpayment. Please contact www.oltersdorf.com for additional information!

Washington, July 28, 2010

The restoration of the single-family rural housing program that would guarantee home loans for rural buyers was passed by the Senate today and is on its way to President Obama.

The National Association of Realtors® has vigorously lobbied to restore funding for the rural program since last March, and hailed this development as a great victory for rural home buyers.

“This is going to be a great lift for thousands of rural home buyers who need to close on their home purchases before Sept. 30 to take advantage of the home buyer tax credit,” said NAR President Vicki Cox Golder, owner of Vicki L. Cox & Associates in Tucson, Ariz. “Many rural families would have been left out in the cold without these guaranteed loans. Increasing the commitment authority will help rural families, support local housing markets, create jobs and generate new tax revenues,” Golder said.

“The rural housing program is a good example of the kind of program needed for responsible and qualified home buyers who bring common sense to the housing market,” said Golder. The legislation increases the guarantee fee for borrowers, but allows the fee to be financed. “This change will make the program completely self-sufficient,” she said.

Golder thanked Sen. Michael Bennet (D-Colo.), and Reps. Paul Kanjorski (D-Pa.) and Shelley Moore Capito (R-W.Va.) for moving the bill to passage in both houses.

The legislation was part of H.R. 4899, “The Emergency Supplemental Appropriations Act” that the Senate passed today. The measure increases the Rural Housing Service commitment authority allowing guaranteed loans; previously, RHS has been providing conditional commitments. The RHS is expected to announce new guidelines shortly after the president signs the bill.

The National Association of Realtors®, “The Voice for Real Estate,” is America’s largest trade association, representing 1.1 million members involved in all aspects of the residential and commercial real estate industries.

Copyright National Association of REALTORS®. Reprinted with permission.

Jonathan Oltersdorf

/

I have calculated the updated 2010 home sales data for Traverse City / Grand Traverse County and have posted the information below. The sales statistics compare housing sold in Grand Traverse County from January 1, 2010 through June 30, 2010 to the same time period in 2009 and 2008. This includes the townships of Acme, Blair, East Bay, Fife Lake, Garfield, Grant, Green Lake, Long Lake, Mayfield, Paradise, Peninsula, Union, Whitewater, and the City of Traverse City. As you will see in the data below, the number of homes sold is up over 31% in 2010 compared to the same time in 2009. Home sales volume in Grand Traverse County is up 39% this year over 2009. Average sales price and median sales price also have increased 5.5% and 5.3% over last year.

-Jonathan Oltersdorf

http://www.oltersdorf.com

This report is based upon sales information obtained from the Traverse Area Multiple Listing Service from 2008-2010. Undisclosed sales are not included in the data.

I have calculated the updated 2010 home sales data for Leelanau County and have posted the information below in several charts. The sales statistics compare housing sold in Leelanau County from January 1, 2010 through June 30, 2010 to the same time period in 2009 and 2008. This includes the townships of Bingham, Centerville, Cleveland, Elmwood, Empire, Glen Arbor, Kasson, Leelanau, Leland, Solon, Suttons Bay, and the City of Traverse City within Leelanau County. As you will see in the data below home sales throughout Leelanau County are up 19% in 2010 over 2009. Median sale price has increased slightly in 2010 over 2009 and sales volume remains steady with a 4% increase.

Interlochen Public Radio have posted a nice article along with audio of a hot topic among farmers in the Traverse City - Leelanau area dealing with leasing of mineral rights. The full article and audio can be found on their website here: A Drilling Boom: Saving Farms, Or Contaminating? . They have interviewed several Leelanau County property owners and explain the debate over the future of natural gas in our area.

-Jonathan Oltersdorf