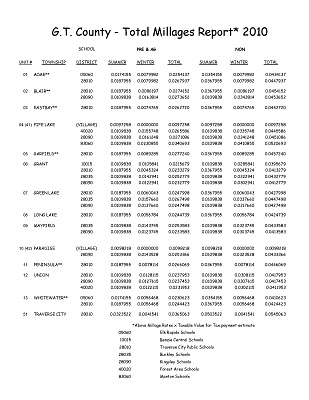

Below is the apportionment chart provided by the Grand Traverse County – Traverse City Equalization Department showing anticipated 2011 millage rates. This is the chart that is used to figure your estimated 2011 tax bill. In late February all Grand Traverse County – Traverse City property owners will be mailed their new notice of assessment informing them of their updated 2011 State Equalized Value and Taxable Value on their property. Have you ever wondered what your property taxes would be if you lived in another township, or if you switched your homestead status to your non-primary home? The chart below is extremely helpful in comparing property taxes in all Grand Traverse County Townships whether you are in the City of Traverse City or Long Lake Township, etc. You can download the PDF by clicking HERE or on the image below. To figure your estimated tax bill, take your taxable value from your notice of assessment (or approximate house value divided by 2) and multiply it by your township millage rate on the chart (make sure you have the correct school district and homestead status).

For Example – Downtown Traverse City primary home with a Taxable Value of $100,000 (house value of $200,000)

$100,000 * (0.0365063) = A yearly tax bill of $3,651

Note: Compared to 2010 property tax rates this home owner will save $120.00. Proposed millage rates will be 3.5% lower in the City of Traverse City.

DOWNLOAD THE CHART BELOW BY CLICKING HERE http://www.oltersdorf.com

http://www.oltersdorf.com

231-271-7777